Have you ever wondered why your sleek, shiny metal credit card feels so… secure? Is it the weight? The design? Or is it that tiny chip embedded into the card that’s doing all the heavy lifting? Let’s face it—chip security isn’t just a buzzword; it’s the unsung hero of modern personal finance. But what happens when you pair this technology with luxe metal cards? Spoiler alert: it’s both genius and tricky.

In today’s post, we’ll explore the ins and outs of chip security in metal credit cards—the good, the bad, and the ugly. You’ll learn how these chips keep your information safe, common pitfalls to avoid, and even some pro tips for maximizing their benefits. Let’s dive in!

Table of Contents

- Introduction: What Makes Metal Credit Cards Different?

- The Problem: Are Metal Cards More Secure Than Plastic?

- Step-by-Step Guide to Understanding Chip Security

- 7 Pro Tips for Safeguarding Your Metal Credit Card

- Real-Life Example: How One Cardholder Avoided Fraud with an EMV Chip

- FAQs About Chip Security on Metal Credit Cards

- Conclusion: Embrace the Future of Personal Finance

Key Takeaways

- Chip security plays a crucial role in protecting your financial data from fraud and breaches.

- Metal credit cards often come with advanced chip encryption but require extra vigilance due to higher visibility among scammers.

- You can boost your card’s safety by regularly monitoring transactions and enabling two-factor authentication (2FA).

- Despite their premium appeal, not all metal cards are created equal when it comes to chip technology.

Introduction: What Makes Metal Credit Cards Different?

I won’t lie—I once thought getting a metal credit card was purely about flexing at checkout. “Oh hey, look at my *stainless steel* Amex,” I bragged internally while fumbling through self-checkout at Target. Reality check: these cards aren’t just status symbols; they’re packed with cutting-edge tech, including EMV chips designed to enhance chip security.

But here’s the kicker: as much as I love the satisfying clink of pulling out a metal card, there’s always been this gnawing worry. Is my fancy card really safer than those flimsy pieces of plastic? Well, buckle up—we’re about to uncover the truth.

The Problem: Are Metal Cards More Secure Than Plastic?

“Optimist Me:” Surely paying $500 annually for a shiny titanium card means impenetrable security, right?

“Grumpy Me:” LOL nope. That glossy exterior makes you a bigger target for fraudsters.

Here’s the deal: metal cards are inherently flashier, which draws attention—and not always the kind you want. While most issuers equip these elite cards with robust chip security features, like dynamic cryptograms and encryption protocols, the mere perception of wealth can attract phishing attempts and scams.

To make matters worse, many people assume that because they have a high-end card, they don’t need to take additional precautions. Newsflash: scammers couldn’t care less whether your card is made of gold or aluminum foil if they can skim its chip details.

This leads us to our next section: understanding exactly how chip security works and why it matters more than ever.

Step-by-Step Guide to Understanding Chip Security

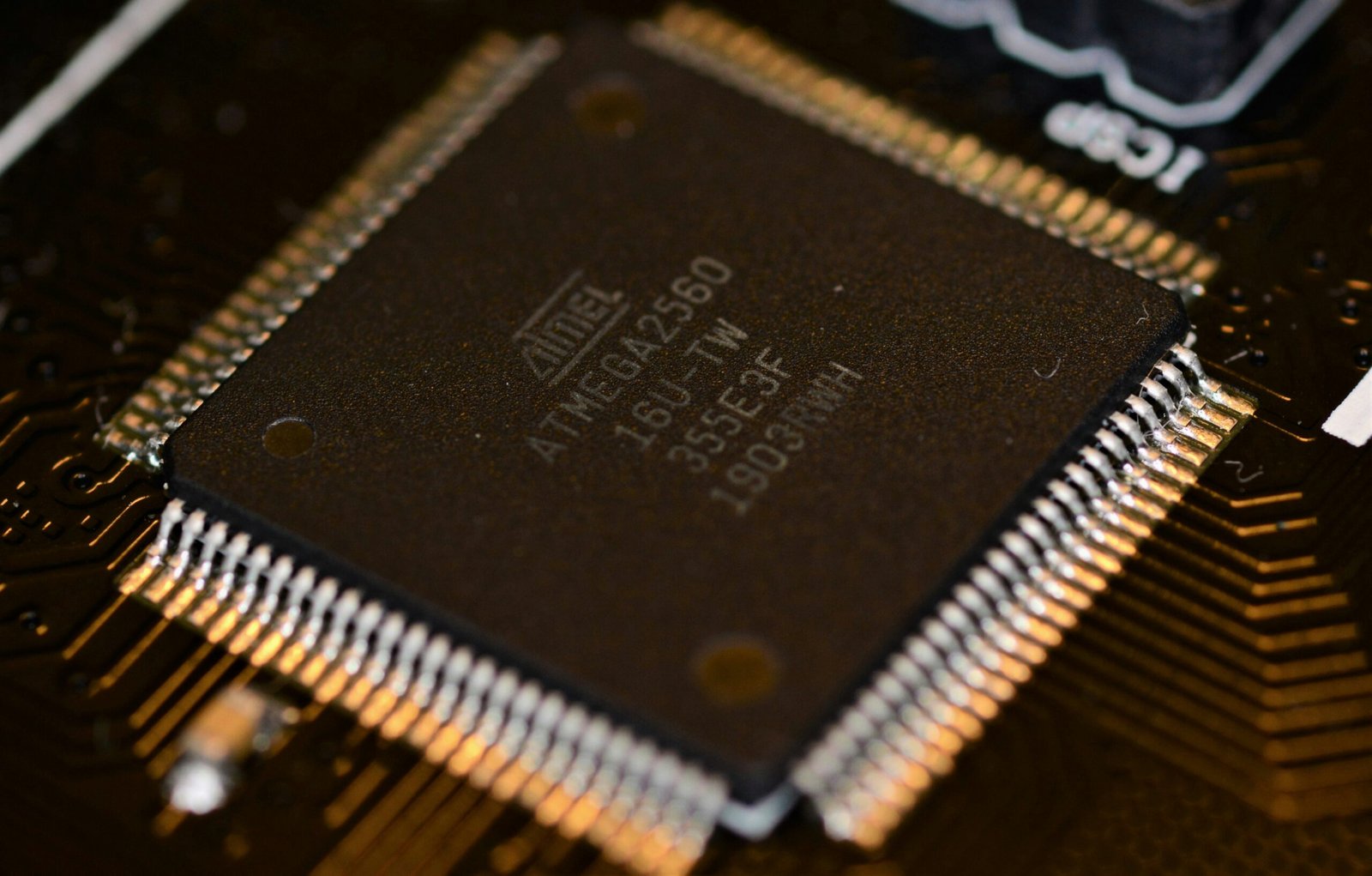

What Is an EMV Chip, Anyway?

An EMV (Europay, Mastercard, Visa) chip is essentially your card’s brainchild. Unlike magnetic stripes, which store static data easily copied by hackers, chips generate unique codes for each transaction. Think of it as giving every purchase its own secret handshake.

How Does Chip Encryption Work?

When you dip your card during checkout, the chip communicates with the payment terminal using end-to-end encryption. This ensures that sensitive info never leaves the system unscathed. Even better, most modern chips support contactless payments via NFC, adding another layer of convenience without sacrificing safety.

Why Does Material Matter?

Metal cards may look cool, but what truly counts is the quality of their embedded chips. Some issuers skimp on chip durability to cut costs, leaving consumers vulnerable to wear-and-tear issues over time. Always research your issuer’s reputation before signing up.

7 Pro Tips for Safeguarding Your Metal Credit Card

- Enable Alerts: Most banks offer real-time notifications for suspicious activity. Turn them on—it’s free peace of mind.

- Update Your PIN Regularly: Yes, remembering new numbers is annoying, but it keeps crooks guessing.

- Use Contactless Payments Wisely: While convenient, be mindful of where and how you tap your card.

- Avoid Public Wi-Fi When Shopping Online: Hackers love stealing card info over unsecured networks. Stick to cellular data or use a VPN.

- Shred Statements Carefully: Dumpster-diving identity thieves exist. Protect yourself by shredding anything with account info.

- Check for Wear and Tear: Inspect your card regularly for scratches near the chip area. Damaged chips = compromised security.

- Dispute Unauthorized Charges Immediately: Federal laws protect you from liability, but only if you act fast.

Real-Life Example: How One Cardholder Avoided Fraud with an EMV Chip

Jane D., a financial consultant based in NYC, narrowly escaped disaster thanks to her card’s built-in chip security. After dinner at a local restaurant, she noticed unauthorized charges flagged in her mobile app alerts. Suspecting foul play, Jane contacted her bank immediately and discovered someone had attempted to duplicate her card’s magnetic stripe. Luckily, her card’s EMV chip prevented full access to her account.

Moral of the story? Never underestimate the power of proactive measures combined with top-notch chip technology.

FAQs About Chip Security on Metal Credit Cards

Do All Metal Cards Use Advanced Chip Technology?

Not necessarily. Issuers vary widely in terms of chip standards. Always confirm specifics before applying.

Can Chips Be Hacked?

While extremely difficult, determined hackers might still find vulnerabilities. However, combining chip security with other protections significantly reduces risk.

Should I Worry About Physical Damage Affecting My Card’s Security?

Yes—if the chip gets scratched or bent, its functionality could degrade. Handle your card with care, especially given its material sensitivity.

Conclusion: Embrace the Future of Personal Finance

At the end of the day, owning a metal credit card equipped with state-of-the-art chip security doesn’t guarantee immunity from fraud—but it certainly gives you a fighting chance. By staying informed, practicing smart habits, and taking advantage of tools provided by your issuer, you can enjoy both luxury and safety in one sleek package.

Remember, though: “With great power comes great responsibility.” So go ahead, flaunt that shiny piece of metal—but do it wisely.

Like peanut butter and jelly,

Chip security + metal cards = perfect harmony.