Have you ever worried about someone hacking into your shiny metal credit card account? You’re not alone.

In an age where cybercriminals are getting craftier, securing your financial accounts is no longer optional—it’s essential. But here’s the kicker: 90% of all breaches could be prevented with just one extra layer of security—Two-Factor Authentication (2FA). If you’re a proud owner of a sleek metal credit card and want to keep it safe, this guide has everything you need to know.

This post will walk you through:

- What Two-Factor Authentication really means (and why you can’t afford to ignore it),

- Step-by-step instructions to enable 2FA on your accounts,

- Best practices to maximize its effectiveness,

- Real-life examples of how 2FA saved users from fraud.

Let’s dive in!

Table of Contents

- Key Takeaways

- Why 2FA Matters for Metal Credit Cards

- How to Enable Two-Factor Authentication

- Tips to Make Your 2FA Foolproof

- Success Stories: How 2FA Prevented Fraud

- Frequently Asked Questions About 2FA

Key Takeaways

- Two-Factor Authentication adds a critical second layer of protection to your accounts.

- Metal credit cards often come with premium perks but require higher security measures like 2FA.

- Enable 2FA using apps, SMS codes, or biometrics, depending on what works best for you.

- Avoid common pitfalls such as relying solely on email notifications for authentication.

Why 2FA Matters for Metal Credit Cards

Metal credit cards scream sophistication—they’re exclusive, durable, and often linked to high-value rewards programs. But let me tell you a story that’ll make your wallet sweat. A friend of mine (we’ll call her Sarah) had her luxury titanium card compromised because she skipped enabling Two-Factor Authentication. One day, she logged in to find unauthorized transactions worth thousands—and zero recourse since she hadn’t secured her account properly.

Sure, these cards look badass—but they also attract scammers faster than moths to a flame. The good news? Implementing 2FA is simpler than setting up Bluetooth headphones (and way less frustrating).

How to Enable Two-Factor Authentication

Optimist You: *This sounds so easy!*

Grumpy Me: *Ugh, fine—but only if I have coffee in hand.*

Here’s how to activate 2FA on most platforms linked to your metal credit card:

Step 1: Check Compatibility with Your Bank

Not all banks support every type of 2FA. Visit your issuer’s website or app to confirm available options. Most likely, they’ll offer:

- SMS Codes: Receive a code via text message.

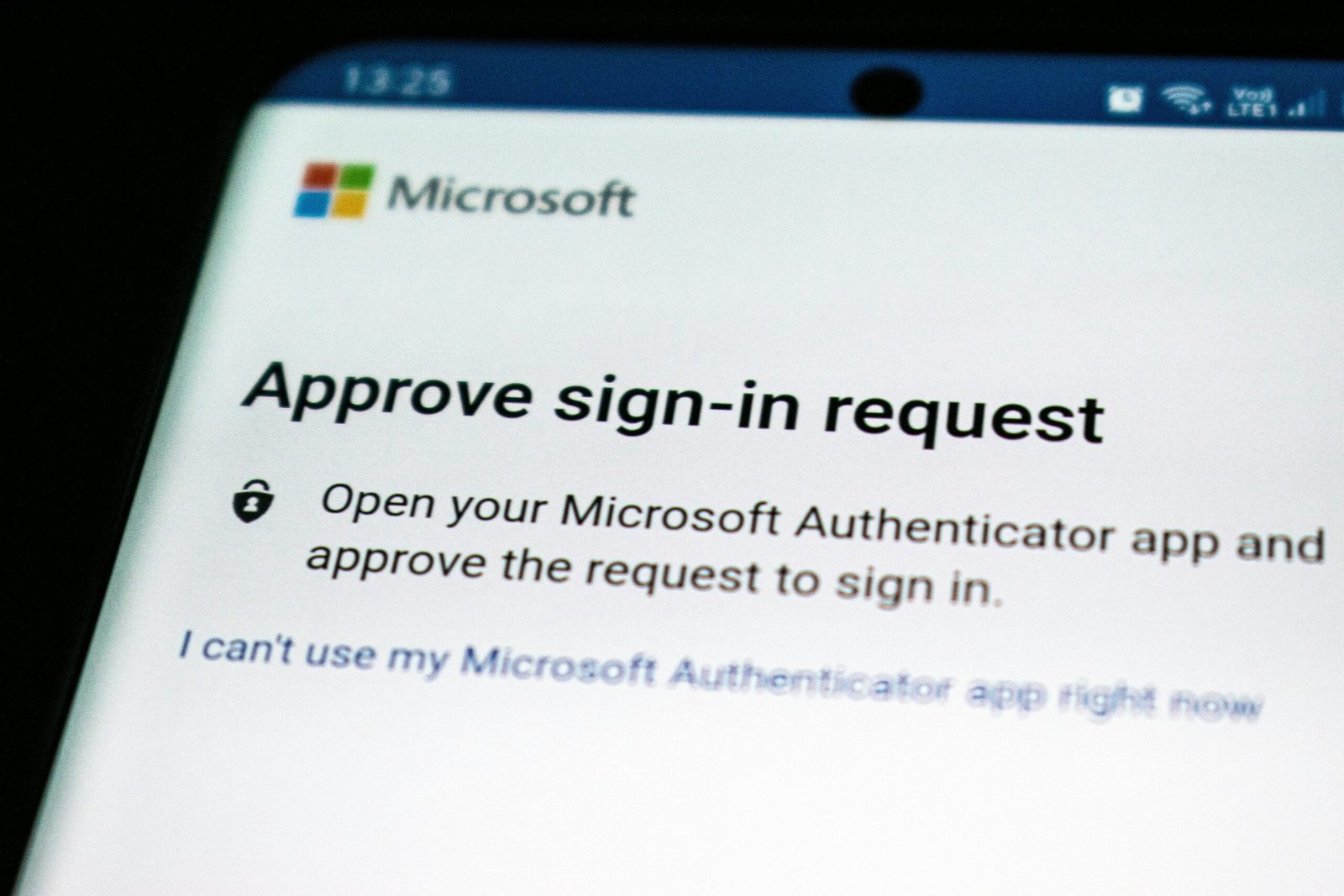

- Authenticator Apps: Use Google Authenticator or Authy.

- Biometric Verification: Fingerprint or facial recognition.

Step 2: Navigate to Security Settings

Once inside your account dashboard, head to “Security” or “Account Settings.” Look for an option labeled “Two-Factor Authentication,” “Multi-Factor Authentication,” or something similar. Click “Enable.”

Step 3: Choose Your Preferred Method

Select the method you feel most comfortable with. Pro tip: Authenticator apps are generally more secure than SMS due to SIM-swapping risks.

Step 4: Save Backup Codes

You’ll usually receive backup codes during setup. Store them somewhere safe—not under your mattress, though!

Tips to Make Your 2FA Foolproof

- Don’t Rely Solely on SMS: SIM swapping attacks happen. Go for app-based tokens instead.

- Keep Your Phone Secure: Always lock your device with a password, PIN, or biometric login.

- Update Recovery Contacts Regularly: Ensure your bank has your current phone number and email address.

- Beware Public Wi-Fi: Avoid logging into sensitive accounts when connected to unsecured networks.

Rant Section: Seriously, folks, why do people still use public Wi-Fi without a VPN?! It’s like handing over your house keys to strangers at a party.

Success Stories: How 2FA Prevented Fraud

Meet Tom, who narrowly avoided disaster thanks to 2FA. When hackers tried accessing his account after stealing his credentials from a data breach, they were stopped cold by the additional verification step requiring his phone. Moral of the story? Even the slickest fraudsters get stumped by 2FA. #ChefKiss

Frequently Asked Questions About 2FA

Q: Is 2FA necessary for my metal credit card?

Absolutely. Given the high stakes, skipping 2FA is like driving without seatbelts—risky business.

Q: Can I disable 2FA once it’s enabled?

Technically, yes. But please don’t. Disabling 2FA exposes your account to unnecessary risk.

Q: What happens if I lose access to my phone?

If you’ve saved backup codes, breathe easy. Otherwise, contact customer support ASAP.

Conclusion

To recap:

- Two-Factor Authentication protects your precious metal credit card from sneaky cybercriminals.

- Enabling 2FA is straightforward—just follow the steps outlined above.

- Combine 2FA with other smart habits like strong passwords and regular monitoring for maximum peace of mind.

Now go forth and fortify your finances—you’ve got this.

P.S. Here’s a haiku for ya:

Cards gleam, thieves scheme too,

Enable 2FA today,

Sleep soundly tonight.